Land Gains Tax In Vermont . the vermont land gains tax is imposed on gains attributable to the sale of land held for less than six years. vermont is currently the only state which employs a special capital gains tax on certain land sales. a tax on the realized capital gain from the transfer of vermont land held for six years or less. three options for filing land gains tax. in cases coming within this subsection, the commissioner of taxes may require the seller or transferor to file a land gains tax. Vermont’s land gains tax is a tax on the sale or exchange of subdivided land in. vermont taxes any capital gains not eligible for exclusions as ordinary income at a rate up to 8.75%.

from www.formsbank.com

the vermont land gains tax is imposed on gains attributable to the sale of land held for less than six years. vermont is currently the only state which employs a special capital gains tax on certain land sales. Vermont’s land gains tax is a tax on the sale or exchange of subdivided land in. vermont taxes any capital gains not eligible for exclusions as ordinary income at a rate up to 8.75%. in cases coming within this subsection, the commissioner of taxes may require the seller or transferor to file a land gains tax. a tax on the realized capital gain from the transfer of vermont land held for six years or less. three options for filing land gains tax.

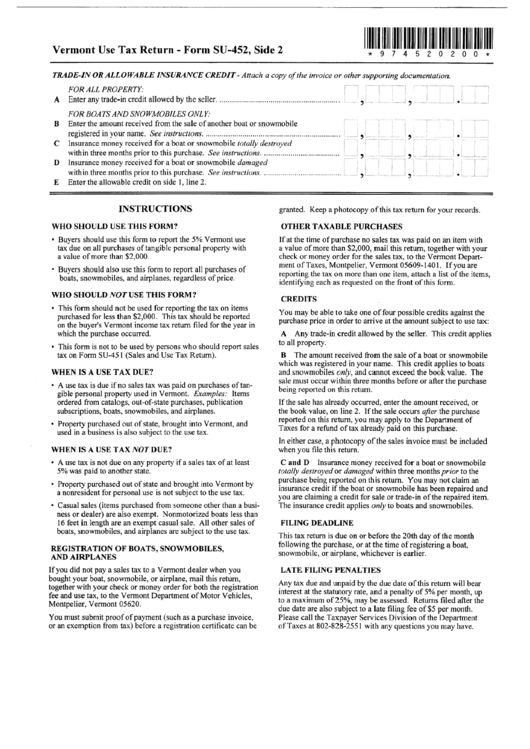

Vermont Use Tax Return Form Su452 Instructions printable pdf download

Land Gains Tax In Vermont vermont taxes any capital gains not eligible for exclusions as ordinary income at a rate up to 8.75%. the vermont land gains tax is imposed on gains attributable to the sale of land held for less than six years. Vermont’s land gains tax is a tax on the sale or exchange of subdivided land in. vermont taxes any capital gains not eligible for exclusions as ordinary income at a rate up to 8.75%. vermont is currently the only state which employs a special capital gains tax on certain land sales. in cases coming within this subsection, the commissioner of taxes may require the seller or transferor to file a land gains tax. three options for filing land gains tax. a tax on the realized capital gain from the transfer of vermont land held for six years or less.

From www.templateroller.com

VT Form LGT178 Fill Out, Sign Online and Download Fillable PDF Land Gains Tax In Vermont three options for filing land gains tax. Vermont’s land gains tax is a tax on the sale or exchange of subdivided land in. vermont taxes any capital gains not eligible for exclusions as ordinary income at a rate up to 8.75%. in cases coming within this subsection, the commissioner of taxes may require the seller or transferor. Land Gains Tax In Vermont.

From www.templateroller.com

Download Instructions for VT Form LGT181 Land Gains Basis Calculation Land Gains Tax In Vermont the vermont land gains tax is imposed on gains attributable to the sale of land held for less than six years. vermont is currently the only state which employs a special capital gains tax on certain land sales. vermont taxes any capital gains not eligible for exclusions as ordinary income at a rate up to 8.75%. . Land Gains Tax In Vermont.

From www.landwatch.com

Wheelock, Caledonia County, VT Undeveloped Land, Lakefront Property Land Gains Tax In Vermont in cases coming within this subsection, the commissioner of taxes may require the seller or transferor to file a land gains tax. a tax on the realized capital gain from the transfer of vermont land held for six years or less. vermont taxes any capital gains not eligible for exclusions as ordinary income at a rate up. Land Gains Tax In Vermont.

From www.templateroller.com

VT Form LGT174 Download Fillable PDF or Fill Online Land Gains Land Gains Tax In Vermont Vermont’s land gains tax is a tax on the sale or exchange of subdivided land in. vermont taxes any capital gains not eligible for exclusions as ordinary income at a rate up to 8.75%. in cases coming within this subsection, the commissioner of taxes may require the seller or transferor to file a land gains tax. vermont. Land Gains Tax In Vermont.

From www.templateroller.com

Download Instructions for VT Form LGT179 Vermont Land Gains Schedules Land Gains Tax In Vermont vermont taxes any capital gains not eligible for exclusions as ordinary income at a rate up to 8.75%. a tax on the realized capital gain from the transfer of vermont land held for six years or less. three options for filing land gains tax. in cases coming within this subsection, the commissioner of taxes may require. Land Gains Tax In Vermont.

From www.reuters.com

TrumpXi trade armistice clears way for more market gains Reuters Land Gains Tax In Vermont a tax on the realized capital gain from the transfer of vermont land held for six years or less. Vermont’s land gains tax is a tax on the sale or exchange of subdivided land in. vermont taxes any capital gains not eligible for exclusions as ordinary income at a rate up to 8.75%. three options for filing. Land Gains Tax In Vermont.

From www.formsbank.com

Form Lg1 Vermont Land Gains Withholding Tax Return printable pdf Land Gains Tax In Vermont the vermont land gains tax is imposed on gains attributable to the sale of land held for less than six years. vermont taxes any capital gains not eligible for exclusions as ordinary income at a rate up to 8.75%. Vermont’s land gains tax is a tax on the sale or exchange of subdivided land in. three options. Land Gains Tax In Vermont.

From www.formsbank.com

Fillable Form Lg2 Vermont Land Gains Tax Return printable pdf download Land Gains Tax In Vermont a tax on the realized capital gain from the transfer of vermont land held for six years or less. Vermont’s land gains tax is a tax on the sale or exchange of subdivided land in. three options for filing land gains tax. the vermont land gains tax is imposed on gains attributable to the sale of land. Land Gains Tax In Vermont.

From www.templateroller.com

Download Instructions for VT Form LGT177 Vermont Land Gains Land Gains Tax In Vermont Vermont’s land gains tax is a tax on the sale or exchange of subdivided land in. a tax on the realized capital gain from the transfer of vermont land held for six years or less. in cases coming within this subsection, the commissioner of taxes may require the seller or transferor to file a land gains tax. . Land Gains Tax In Vermont.

From www.templateroller.com

Download Instructions for VT Form LGT179 Vermont Land Gains Schedules Land Gains Tax In Vermont three options for filing land gains tax. a tax on the realized capital gain from the transfer of vermont land held for six years or less. Vermont’s land gains tax is a tax on the sale or exchange of subdivided land in. the vermont land gains tax is imposed on gains attributable to the sale of land. Land Gains Tax In Vermont.

From www.templateroller.com

Download Instructions for Form LGT178 Vermont Land Gains Tax Return Land Gains Tax In Vermont the vermont land gains tax is imposed on gains attributable to the sale of land held for less than six years. vermont is currently the only state which employs a special capital gains tax on certain land sales. three options for filing land gains tax. vermont taxes any capital gains not eligible for exclusions as ordinary. Land Gains Tax In Vermont.

From www.templateroller.com

VT Form LGT181 Fill Out, Sign Online and Download Fillable PDF Land Gains Tax In Vermont vermont is currently the only state which employs a special capital gains tax on certain land sales. Vermont’s land gains tax is a tax on the sale or exchange of subdivided land in. three options for filing land gains tax. the vermont land gains tax is imposed on gains attributable to the sale of land held for. Land Gains Tax In Vermont.

From wisevoter.com

Capital Gains Tax by State 2023 Wisevoter Land Gains Tax In Vermont in cases coming within this subsection, the commissioner of taxes may require the seller or transferor to file a land gains tax. the vermont land gains tax is imposed on gains attributable to the sale of land held for less than six years. a tax on the realized capital gain from the transfer of vermont land held. Land Gains Tax In Vermont.

From www.templateroller.com

Download Instructions for VT Form LGT178 Vermont Land Gains Tax Return Land Gains Tax In Vermont Vermont’s land gains tax is a tax on the sale or exchange of subdivided land in. three options for filing land gains tax. vermont is currently the only state which employs a special capital gains tax on certain land sales. a tax on the realized capital gain from the transfer of vermont land held for six years. Land Gains Tax In Vermont.

From www.templateroller.com

Vermont Vermont Land Gains Schedules Fill Out, Sign Online and Land Gains Tax In Vermont three options for filing land gains tax. a tax on the realized capital gain from the transfer of vermont land held for six years or less. the vermont land gains tax is imposed on gains attributable to the sale of land held for less than six years. Vermont’s land gains tax is a tax on the sale. Land Gains Tax In Vermont.

From www.formsbank.com

Vermont Land Gains Tax Return (Form Lg2) Instructions For Seller Land Gains Tax In Vermont vermont is currently the only state which employs a special capital gains tax on certain land sales. a tax on the realized capital gain from the transfer of vermont land held for six years or less. Vermont’s land gains tax is a tax on the sale or exchange of subdivided land in. vermont taxes any capital gains. Land Gains Tax In Vermont.

From www.formsbank.com

Vermont Use Tax Return Form Su452 Instructions printable pdf download Land Gains Tax In Vermont three options for filing land gains tax. vermont is currently the only state which employs a special capital gains tax on certain land sales. Vermont’s land gains tax is a tax on the sale or exchange of subdivided land in. the vermont land gains tax is imposed on gains attributable to the sale of land held for. Land Gains Tax In Vermont.

From www.formsbank.com

Instruction For Form Lg1 Vermont Land Gains Withholding Tax Return Land Gains Tax In Vermont the vermont land gains tax is imposed on gains attributable to the sale of land held for less than six years. Vermont’s land gains tax is a tax on the sale or exchange of subdivided land in. vermont taxes any capital gains not eligible for exclusions as ordinary income at a rate up to 8.75%. three options. Land Gains Tax In Vermont.